Origin Bank

As Origin Bank’s marketing partner since 2013, Zehnder has helped guide the Bank through a name change, a website rebuild, multiple campaigns and forays into social media, content marketing and more. In 2017, Origin approached Zehnder with the goal of making banking personal again—essentially reminding customers that Origin relationships are deeper than transactions.

Today when most banks are capitalizing on automated systems, Origin Bank is reminding customers of the value of good ole face-to-face relationships. Technology is critical for efficiency, but cannot replace trust, honesty and integrity. These traits are only present through human interaction. Zehnder helped Origin prove just that with the launch of its Relationship Banking campaign.

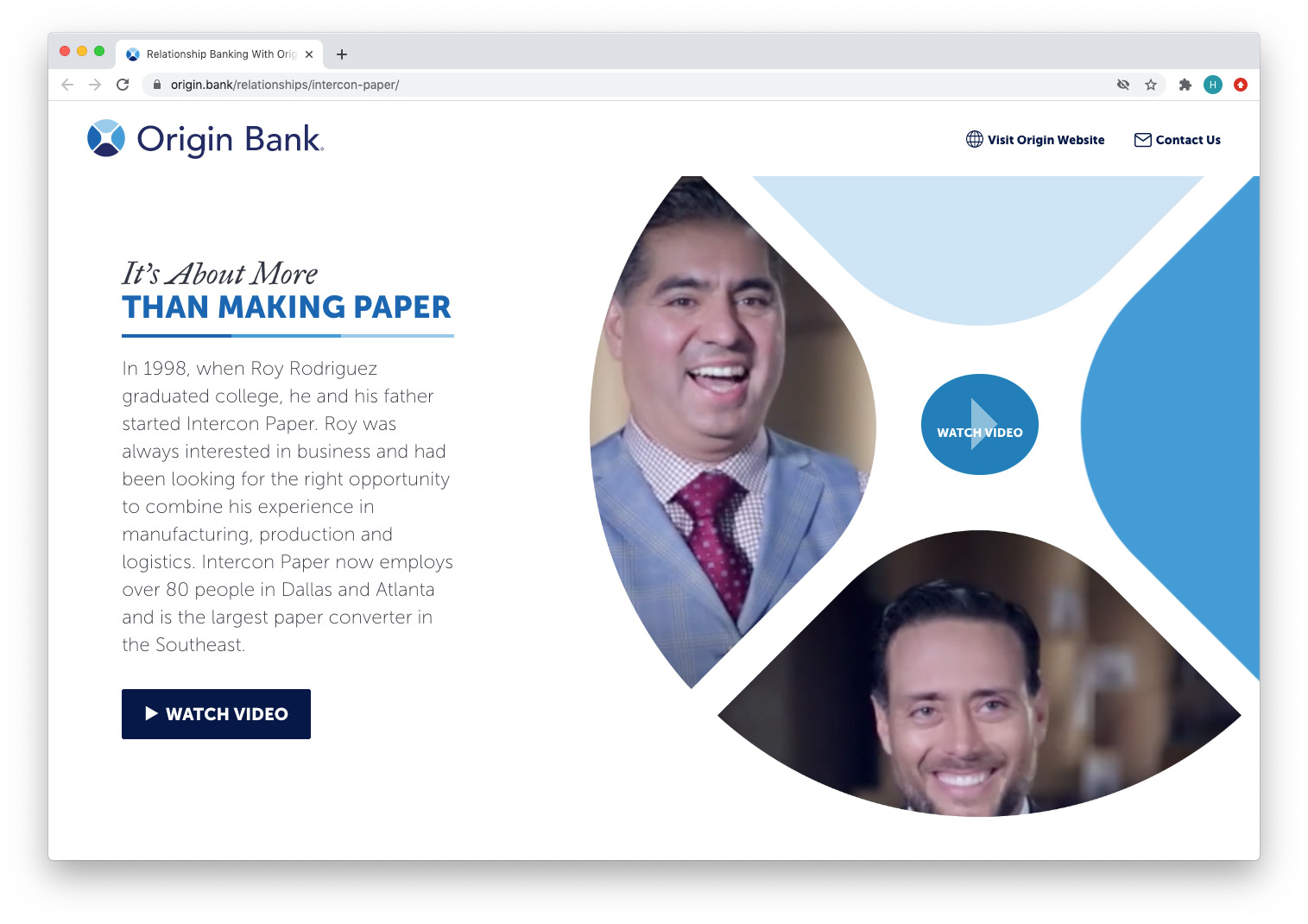

Zehnder set out to spotlight the authentic relationships between real business customers and Origin bankers in an unexpected way. Over 6 months Zehnder hit the road traveling across Louisiana, Texas and Mississippi to create a 28-part webisode series. All the while, capturing stories that were far from boring – from a custom handbag designer to a famous chef to a visionary architect, a cookie maker, a health food entrepreneur, a woman who builds industrial tanks and a pro golfer – we interviewed them all. No scripts, no cheesy actors, just intriguing stories, straight from the customers whose business aspirations have been fulfilled through advice, trust and personal relationships with Origin Bank.

The Origin Bank “Return on Relationships” campaign is not just your typical testimonial strategy. We created an online platform for current and prospective customers to learn more and ultimately drive lead generation. Our strategy and digital teams collaborated to build out data and behavioral-driven landing pages that drive visitors to custom-built pages based on a customer’s stage in the buying funnel from awareness, consideration, evaluation and decision.

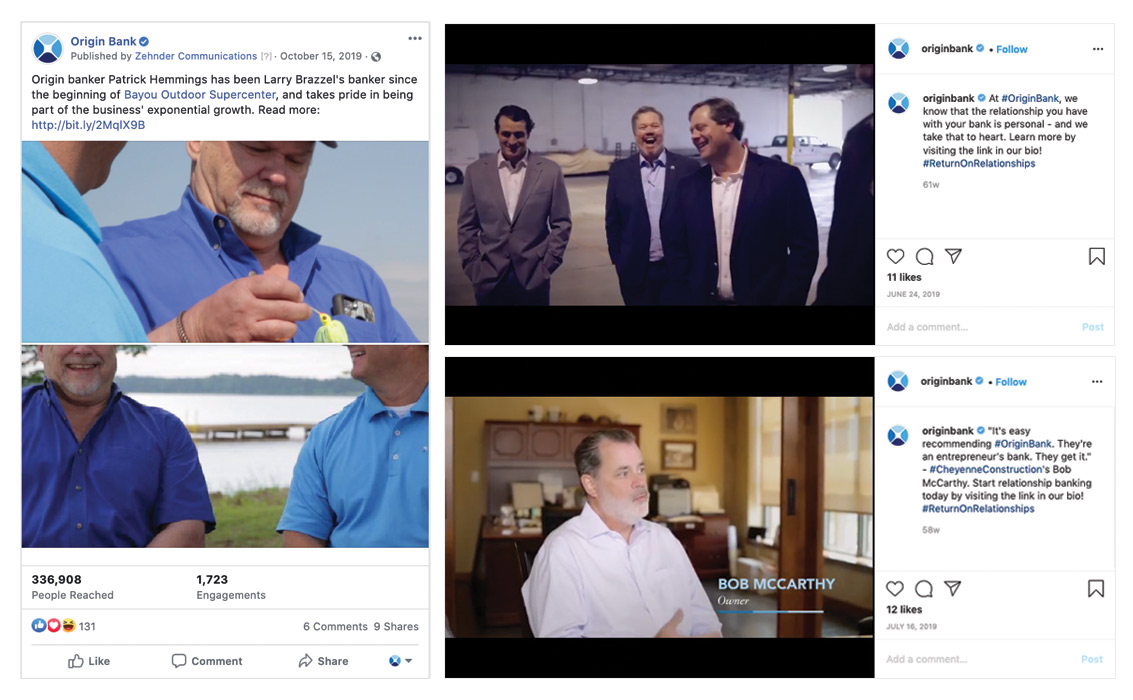

The visual storytelling aspect of television and video cannot be denied, but a television buy in multiple markets can be cost-prohibitive. Social Media, on the other hand, is not only more cost-efficient, but it is also highly targeted. We placed Origin’s message in front of the RIGHT prospects and customers, at the RIGHT time, in the RIGHT places and with customized, relevant content that engages small business and commercial clients during those critical banking micro-moments such as applying for a line of credit, cash flow management solutions, insurance and investment advice.

A combination of Facebook, LinkedIn, Twitter, YouTube and Instagram work together to amplify the value of Origin Bank relationships. To make sure we get the best visibility in this rapidly evolving space, our paid media, public relations and social media teams work closely together, and with platform representatives, to implement best practices across our paid, earned and owned social media efforts. This involves staying updated on new social media features and trends like live broadcasting “stories”, strategic awareness or lead-gen capabilities and A/B testing for ad placements, and emerging technology to consider for future content, like 360 video and augmented/virtual reality.

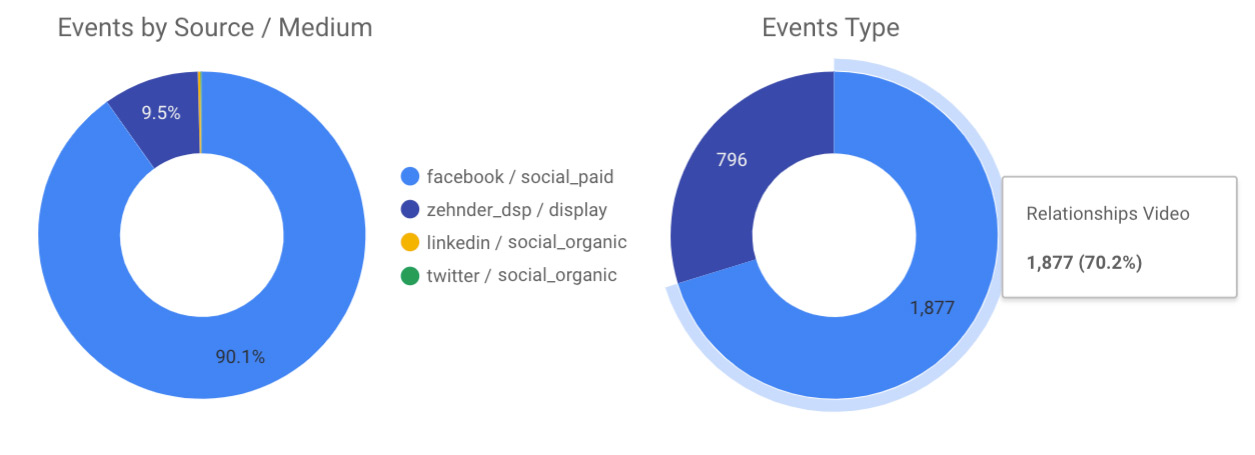

It’s all about results and we measure everything. Zehnder utilized Google Data Studios to develop a custom dashboard based on a multitude of campaign KPIs from branded search to video completion to ad recall and web visitation. Custom URLs were developed to track, monitor and optimize each customer/banker story and this data is separated by source, medium, content, geographic location and ad type. But that’s just marketing KPIs. On the business side, Origin Bank was looking to grow its loans and deposits, so business intelligence metrics are key. Web landing pages include custom business conversions including form submission, email capture and direct calls to bankers. In just the first two months of the campaign, Origin Bank received 37 calls from qualified business banking prospects.

Origin’s growth has been so strong in fact that they just went public on the Nasdaq stock exchange.

Many experts believed that face-to-face channels are going away, citing big changes in consumer habits and reduced branch traffic, but new research just confirmed that more than half of all consumers, including Millennials, visited a branch and said they prefer to engage by interacting with bankers versus solely digital. So, it turns out Zehnder and Origin are on to something!